Hľadaj

Zobraz:

Univerzity

Kategórie

Rozšírené vyhľadávanie

45 171

projektov

McDonalds - finančná analýza

| Prípona .doc |

Typ analýza |

Stiahnuté 11 x |

| Veľkosť 0,2 MB |

Jazyk anglický |

ID projektu 2008 |

| Posledná úprava 05.09.2016 |

Zobrazené 4 518 x |

Autor: - |

Zdieľaj na Facebooku

Zdieľaj na Facebooku |

||

| Detaily projektu | ||

- cena:

10 Kreditov - kvalita:

88,9% -

Stiahni

- Pridaj na porovnanie

- Univerzita:Univerzita Komenského v Bratislave

- Fakulta:Fakulta managementu

- Kategória:Finančníctvo » Účtovníctvo

- Predmet:Finančné účtovníctvo

- Študijný program:-

- Ročník:4. ročník

- Formát:MS Office Word (.doc)

- Rozsah A4:16 strán

- Dokumentácia:Stiahni

The Company primarily franchises and operates Mc Donald’s restaurants. In addition, the Company operates certain non-Mc Donald’s brands that are not material to the Company’s overall results. Of the more than 30.000 Mc Donald’s restaurants in over 100 countries, over 8.000 are operated by franchisees / licensees and over 4.000 are operated by affiliates.

The Company owns the land and building or secures long-term leases for both Company-operated and franchised restaurant sites. This ensures long-term occupancy rights, helps control related costs and improves alignment with franchisees. Under Mc Donald’s developmental license arrangement, licensees provide capital for 100% of the business, including the real estate interest, while the company generally has no capital invested.

The Company owns the land and building or secures long-term leases for both Company-operated and franchised restaurant sites. This ensures long-term occupancy rights, helps control related costs and improves alignment with franchisees. Under Mc Donald’s developmental license arrangement, licensees provide capital for 100% of the business, including the real estate interest, while the company generally has no capital invested.

Kľúčové slová:

finančná analýza

Mc Donald’s

financial position

capital recourses

účtovníctvo

Obsah:

- Introduction of the company 2

Share repurchases and dividends 2

Outlook for 2006 2

Financial statements 3

Consolidated income statement 3

Consolidated balance sheet 4

Consolidated cash flow statement 5

Financial Ratios Analysis 6

Profitability ratios 6

Return on assets (ROA) 6

Profit Margin for ROA 6

Total Asset Turnover 7

Common Earnings Leverage 7

Financial Structure Leverage 7

Return on Common Equity (ROCE) 8

Activity Ratios 8

Accounts Receivable Turnover 8

Days receivable outstanding 9

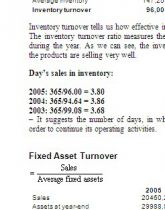

Inventory turnover 9

Fixed Asset Turnover 9

Liquidity ratios 10

Current Ratio 10

Quick Ratio 10

Operating Cash Flow to Current Liabilities 11

Solvency ratios 11

Debt to equity 11

Debt to assets 11

Debt to tangible assets 12

Interest Coverage (earnings) 12

Interest Coverage (cash flow) 12

Notes 13

Financial Position and Capital Recourses 13

Total assets and returns 13

Financing and market risk 13

Conclusion 14

Content 15